The End Sale Period function is used to consolidate the ‘End of Shift’ from each POS Terminal. It is possible if using multi-sites to enter different GL Codes for each site. These will however only be exported from the terminal with the MYOB module installed.

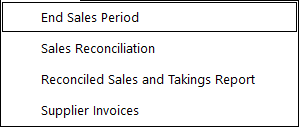

To End the Sale Period go to Accounting > End Sales Period.

All the End of Shifts performed at each POS Terminal will be displayed within the site you have selected.

You have the option to edit the End of Shift figures for each individual End of Shift before you proceed to the next step. You can enter the counted total for each cash drawer at this point, or alternatively you can proceed to the next step and count all the money from each cash drawer together.

One End of Shift per terminal/per day and one End Sales Period per day.

This scenario is where a business uses only one cash drawer float per terminal per day, and at the end of day, the End Sale Period function is performed.

Multiple End of Shifts per terminal/per day and only one End Sale Period per day

This scenario is where a POS Terminal may have more than one End of Shift performed within one day, in which you will be required to reconcile each cash drawer float.

Multiple End of Shifts per terminal/per day with an End of Shift/s not completed

If an End of Shift has not been completed, and you perform an End Sales Period, the sales data for this unfinished shift will not be added to the current End Sale Period.

Businesses that operate over the weekend, but do not do any banking or reconciling of cash drawer floats can either End Sale Period for the whole weekend sales OR perform an End Sale Period at the end of each day, and reconcile their combined End of Shift totals after the weekend.

Tip!

Performing one End Sale Period per day would allow you to send the reconciled banking data to MYOB with each day separated.

The Sales Reconciliation function is the final step before sending sales and banking data to MYOB Accounting Software.

Each Sales Reconciliation is shown line by line. An Audit number is given to each Sales Reconciliation and is sent to MYOB as the journal reference number.

If you are a Multi-Site Business and you have each site connected via a ‘VPN’ Network (Virtual Private Network over the Internet) it is possible to perform Sales Reconciliations for each Site.

If you operate multiple copies of MYOB for each site, you can change the MYOB Company File name BEFORE you send to Accounting. Alternatively, you can use the ‘Save as File’ Option to save the Sales Reconciliation to a file, and transfer to another computer for Importing into MYOB. The ‘IPS Import to MYOB Utility’ is required for this function.

To balance the Sales Reconciliation, highlight the Sales Reconciliation and press Edit. The Sales Reconciliation must balance before Idealpos allows you to send to MYOB.

If there is a variance in between the sales total and the counted cash drawer float, enter either a positive or negative variance amount in the variance box.

Once Sales reconciliations are balanced, a tick will appear in the balanced column and the Sale Reconciliation is now ready to send to MYOB. Press ‘Send to Accounting’ to send to MYOB.

If the Transfer is successful, a tick will appear in the accounting column, and the data has now been sent to MYOB.

To view the transferred data in MYOB, click on ‘Transaction Journal’ in the Accounts Command Centre.

The transferred data has been sent to MYOB as a ‘General Transaction Journal’. Click on the little arrow beside the date to view the contents of the Journal.

The General Journal reference number will match Idealpos’ Sales Reconciliation number (E.G SR000042) and the Memo text will read ‘Transferred from POS’.

Press the ‘View Cash Declaration’ button located at the bottom the Sales Reconciliation screen to view all the Cash Declarations for a single Sales Reconciliation.

The Cash Declaration report shows the Expected Total, Actual Total and Variance for each End of Shift.

If for any reason you need to send the data to MYOB again, you can press the ‘Send to Accounting’ button and a message box will appear, asking you to confirm if you wish to send again.

You can set a password to protect this option from being used accidentally. To set the password, go to Setup > Global Options > Accounting. Enter a password in the ‘Resend to Accounting Password’ box.

Idealpos will now prompt for a password when resending the data.

You can delete a General Transaction Journal in MYOB if necessary. To delete the transferred Sales Reconciliation, open the General Journal Transaction entry, click on the Edit menu and select ‘Delete General Journal Transaction’.

It is possible to edit a Sales Reconciliation AFTER you have sent the data to MYOB. Simply delete the original General Journal Transaction in MYOB, and then resend the edited Sales Reconciliation.